24 Jan The opportunity at the center of the plate

As the world enters a new decade and edges closer to 2050, the challenge of supplying 10 billion people with delicious and sustainable protein looms large. At Lever VC, we invest globally in the best entrepreneurs and companies looking to build the future of global protein through alternative protein products. The alternative protein industry is, however, still somewhat nascent and we believe there is still substantial white space for entrepreneurs and other investors to participate in over the coming decades. In order to contribute to building a vibrant ecosystem, this will be the first in a series of articles documenting some of our research and understanding of the alternative protein space, as well as why we believe that there is a massive opportunity at the center of the plate. It is our hope that this will be beneficial to prospective entrepreneurs and investors who are considering getting involved in this space.

The protein industry is massive, changing, and has a supply problem on the horizon

Animal-based protein is one of the largest industries in the world today. According to FAOSTAT data, almost a third of all agricultural products globally, in value terms, is animal-based protein. In terms of calories, meat, dairy, and eggs provide 15% of daily calories for the average world citizen and that figure is as high as 30% in developed countries like Australia and the USA. The market for meat and dairy alone is expected to be worth between $1.6 and $2.1 trillion (UBS, McKinsey, Statista), which is larger than the global addressable market for several major industries such as hotels, internet service providers as well as advertising and nearly 10 times the addressable market for a major startup like Uber. Without a doubt, global protein supply is one of the most ubiquitous and pressing global consumer needs and will likely continue to be over the next half a century and beyond.

Over the past century, protein production has doubled every three decades globally. It is projected to nearly double again in the next three decades according to FAO data, primarily as a result of rising global wealth. While some of that increase in demand will be met by conventional animal-based protein, consumer trends towards healthier and more sustainable food have led to suggestions from major global consulting groups like McKinsey and AT Kearney that alternative proteins will take a significant share of the protein market over the coming decades. While this suggests that the contents of consumer plates will change fairly significantly over the next few decades, this is not without precedent.

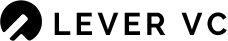

In the United States, beef consumption in the late 1970s (40 years ago) was around 115 pounds per person per year. Today, that number has nearly halved to 58.8 pounds per person per year. Meanwhile, in terms of poultry consumption, American consumption has more than doubled from 47 pounds per person per year 40 years ago, to 112 pounds per person per year today. In China, pork consumption per capita has gone up from 16 pounds per person per year 50 years ago to 67 pounds per person per year today. These cases illustrate how large scale changes are possible (and even likely to happen) at the center of the plate as the world trends, over the next few decades, towards consuming i) more protein and ii) healthier protein.

Apart from the consumer trends towards different sources of protein, the sheer demand for animal protein won’t be able to be met if the developing world starts to eat diets similar to those found in North America and Europe today. Driving these limitations will be key resource limitations for inputs such as land and water, which are increasingly expected to become scarce in various parts of the world over the next decade. In the developed world, while industries such as organic/grass-fed/regenerative animal protein have also benefited from similar consumer tailwinds towards more sustainable products, there is growing evidence that these industries are simply not scalable to anywhere near the production levels required because of the increased land and resource requirements (even if these systems are near carbon neutral). Given the scaling challenges of other systems, we see alternative protein as a necessary and unavoidable part of the food system as we move towards 2050—though also one that is increasingly desired by consumers.

A sustained shift in consumer preferences is well underway, underpinned by the Millenial and Gen Z population

Underlying this shift at the center of the plate are overarching consumer trends towards healthier and more sustainable products. In developed markets like North America and Western Europe, consumers have been shifting their protein consumption to alternatives that are perceived as healthier and more sustainable like plant-based options. Importantly, we note that this shift to alternative proteins is even more apparent in the Millennials and Gen Z. In developed markets like the US, about half of all millennials have eaten plant-based meats in the last year, 73% of Millennial and Gen Z consumers bought a dairy alternative in the last 12 months and Impossible Food’s research shows that nearly half of all Millenials and Gen Zs in the US consume plant-based meat at least once a month. The preferences of Millenial and Gen Z consumers are a powerful tailwind for the alternative proteins industry as Gen Z’s and Millenials are already 60% of the world population and will account for the largest share of aggregate spending power, eclipsing that of Gen X in 2020 as the chart below shows.

Major food companies have begun to invest in the space

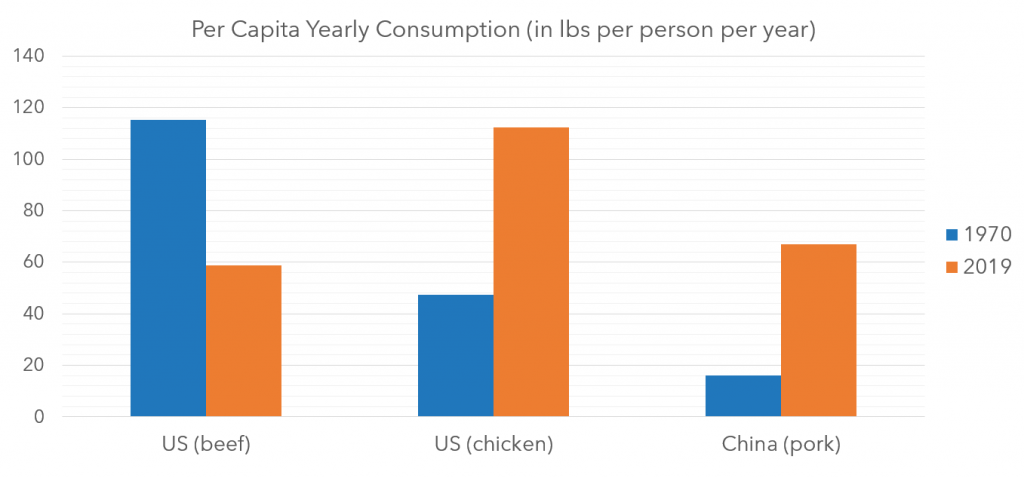

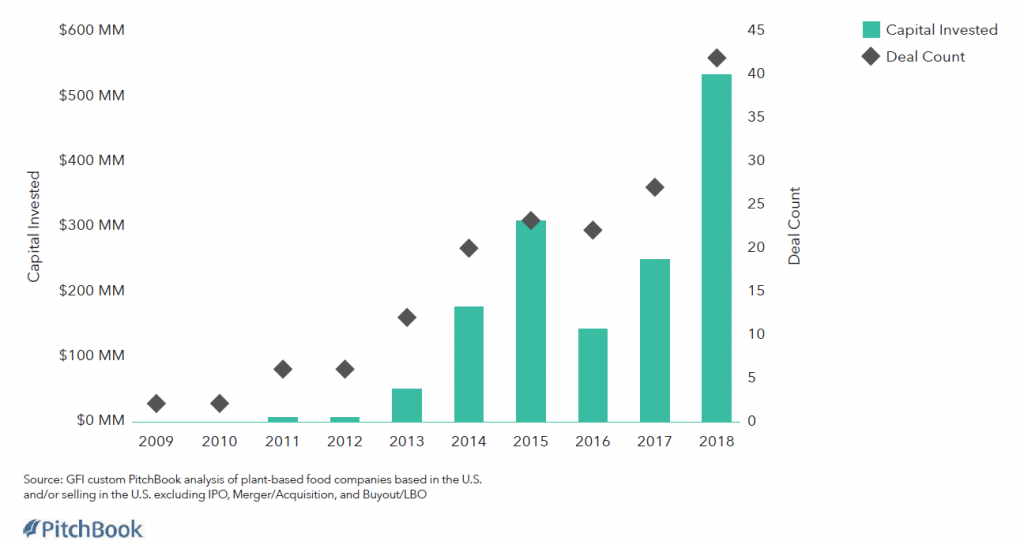

If the alternative proteins industry mimics the penetration trajectory of other analogous substitute products in other categories like electric cars or non-dairy milk, UBS estimates that the meat alternatives market alone will be worth ~$50 billion in 2025 with an expected CAGR of 30%. Dairy alternatives are already at 13% of the US fluid milk market and expected to grow to ~$40 billion in 2025 with a CAGR of 16.7%. These numbers suggest that there are significant opportunities for entrepreneurs and existing food companies, across geographies, to fulfill consumer needs for delicious, healthy and sustainable protein, through product formats that are locally relevant. Industry stakeholders have begun to appreciate the scale of the opportunity as seen by recent data below on the increasing pace of investment into the alternative protein space, by both generalist funds and the venture arms of major global food companies.

In conclusion, the protein industry can expect a significant transformation in the coming decade from supply and demand-side changes that are led by shifting consumer tastes and demographics, and in the coming decades will also be contributed to by carrying capacity limitations on animal agriculture in some parts of the world.

Along with traditional investment funds and large food companies that are already participating in the space, there is an outsized opportunity for additional investors to participate by working with seasoned sector experts who are best positioned to identify and capitalize on opportunities in this quickly expanding market.